Streamline Your Trading: The Benefits of Automation

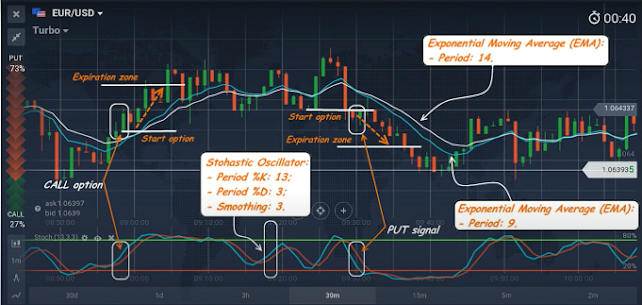

Today, we want to dive into a topic that's close to every trader's heart: automated trading. vfxAlert auto trade feature analyzes market data, execute trades automatically based on predefined criteria. Traders can set specific rules and conditions for buying or selling options, and the automated system will act accordingly. Auto trade helps traders to avoid emotional decisions that may lead to losses. It allows for trading to occur 24/7 without the need for constant monitoring by a human trader. Backtesting is an important feature of automated trading, allowing traders to test their strategies on historical data before risking real money. Let's look at how it works. To get started, connect with a broker. Set up signal preset and conditions for automatic trading. Then enable Auto Trade. Signal preset: Choose assets: EURUSD, USDJPY; expiry time - 15m. Algorithm: Adaptive Signal power: 3,4,5 Amount: no more than 1-3% of the deposit, then you can increas