Simple Pocket Option Strategy with EMA(42), ADX, and vfxAlert Signals

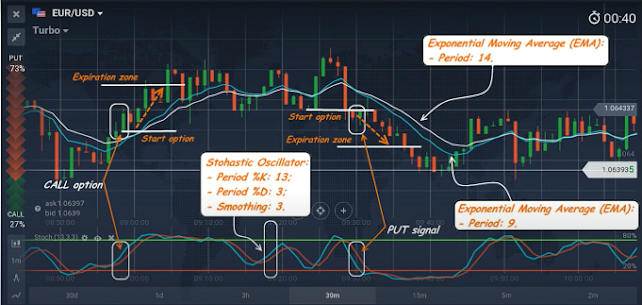

Binary options trading remains one of the most dynamic markets where accuracy and emotional control determine success. In our latest article, we explore a strategy that combines EMA(42) , ADX , and vfxAlert signals to achieve stable, data-driven results with minimal risk. 📊 The Core Idea EMA(42) helps identify the overall market trend. ADX measures trend strength and filters out weak market phases. vfxAlert provides real-time binary signals to confirm entry points. This combination makes the strategy powerful and versatile for currencies, stocks, and cryptocurrencies . It’s suitable for both beginners and experienced traders who prefer clear trading rules over emotional decisions. ⚙️ Inside the Article Step-by-step setup for EMA and ADX indicators Entry and exit rules for CALL and PUT trades Real trade examples and risk management tips Guidance on volume confirmation and early exits 📌 Read the full strategy here: 👉 https://blog.vfxalert.com/en...